The once-in-a-century flooding that occurred in New South Wales and Queensland earlier this year in March caused devastating damage throughout both states.

Parts of Australia’s East Coast saw almost one metre of rain, resulting in the storm drain water and river flooding damaging hundreds of homes and cutting off roads. The devastating floods resulted in over 56,000 insurance claims and caused almost 30,000 people to evacuate their homes during the disaster.

The Insurance Council of Australia, which declared the disaster an insurance catastrophe (CAT212), says assessors immediately flocked to the impacted regions to assist in the recovery process.

Claim Central rapidly activated our catastrophe response plan following the East Coast floods. As a result, we were well prepared to assist in the recovery of damage caused by the storm activity over Australia’s East Coast, especially in Port Macquarie, Kempsey and Coffs Harbour.

Our team of frontline staff, property assessors, make safe trades, repair trades, restorers, and engineers were deployed to the affected areas to attend to customers’ properties.

Claim Central deployed additional resources in the most impacted areas to manage the increased volume of claims, including deploying our assessors from across the country. Equipped with leading technology solutions we were able to ensure critical claim information was captured immediately, resulting in excellent service for our clients and customers.

Claim Central uses virtual collaboration and live streaming technology, Wilbur Live powered by Livegenic, to capture the right information at the right time for every claim. With Wilbur Live we were able to capture the damaged area at the start of a claim journey allowing accurate information to be collected from the beginning of the claim.

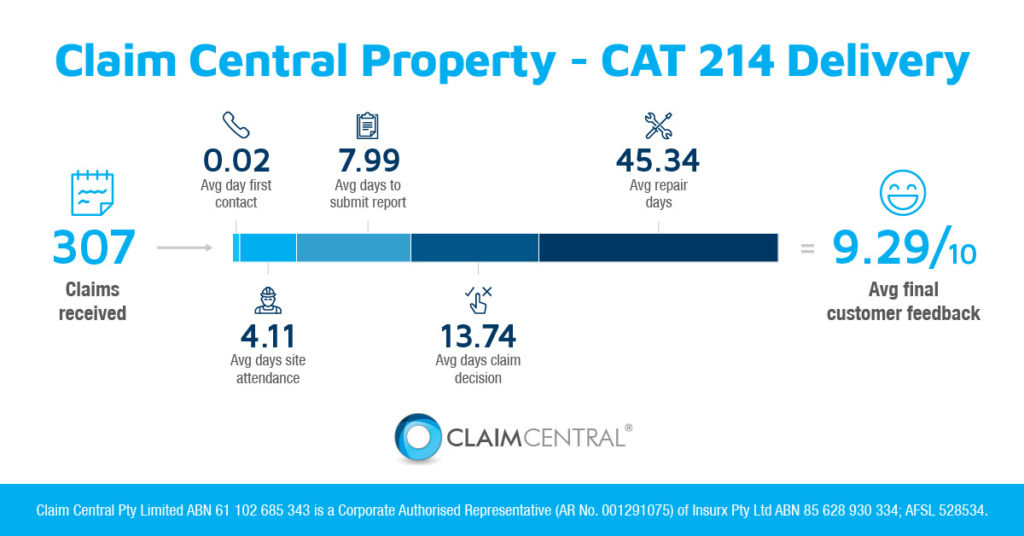

Using our catastrophe response plan and our market-leading technologies, Claim Central has produced great results from the 654 claims received. These results included:

- 2 average days for the policy holder to be contacted once the claim was received

- 77 average days for the assessor to attend the property

- 29 average days for our assessor to submit the report

- 6 average days until the claim decision

- 53 average days for the claim to be repaired and finalised.

Claim Central are proactive in keeping customers informed at every stage of the claim journey and providing a point of contact for each stage. At the very start of the claim, we set clear expectations with customers and successfully manage those expectations through to final Quality Assurance.

Our great service has seen an average of 9.34/10 customer ratings for all claims handled under the NSW and QLD March 2021 catastrophe flood event.

Claim Central Pty Limited ABN 61 102 685 343 is a Corporate Authorised Representative (AR No. 001291075) of Insurx Pty Ltd ABN 85 628 930 334; AFSL 528534. The information in this article is general in nature and does not take into account the investment objectives, financial situation and particular needs of any particular person. Past performance is not an indicator of future performance. Claim Central Pty Limited and its related bodies corporate make no recommendations as to the merits of any financial product or financial services referred to in this article, its website, emails or its related websites. Before acting on any information in this article, you should consider the appropriateness of it, having regard to your specific financial circumstances and requirements. In particular, you should consider obtaining independent financial, legal, taxation and accounting advice to ascertain whether you should acquire any financial services described in this article.